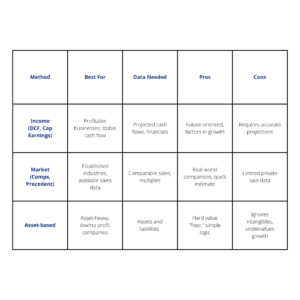

While every business is unique, most valuations rely on one or more of the following approaches:

Asset-Based Approach

This method calculates value based on the company’s fair market value of assets minus liabilities, including both tangible and intangible assets. It’s commonly used for asset-heavy businesses or in liquidation scenarios.

Income Approach

The income approach focuses on future earning potential, often using discounted cash flow (DCF) analysis. This method is widely used for profitable, ongoing businesses and emphasizes cash flow, risk, and growth expectations.

Market Approach

The market approach compares your business to similar companies that have sold recently, using market data and valuation multiples. This approach works best when reliable industry data is available.

At Froehling Anderson, our valuation professionals evaluate which methods are most appropriate based on your industry, size, financial structure, and objectives.