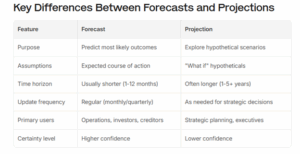

Both financial forecasts and projections are considered prospective financial statements under AICPA Attestation Standards Section 301, meaning they are forward-looking and built on assumptions. But they are not interchangeable.

Financial Forecast

A forecast estimates financial performance based on what you believe will happen based on current data, trends, and planned actions.

Forecast = “Based on what we know today, here’s what we expect.”

Typical uses of a forecast:

- Annual budgeting and planning

- Communicating expectations to investors or lenders

- Predicting revenue, expenses, and cash flow in the near term

Forecasts are especially helpful for companies with steady, predictable performance.

Financial Projection

A projection models possible outcomes based on hypothetical assumptions.

Projection = “What would happen if we…?”

Projections are used to:

- Evaluate future or theoretical scenarios

- Explore new markets, products, or strategic decisions

- Analyze long-term or transformative initiatives

Projections provide flexibility and are ideal when uncertainty or change exists.