Whether you’re applying for financing, planning for growth, or preparing for tax season, choosing the right level of financial statement service—audit, review, or compilation—can make all the difference.

At Froehling Anderson, our experienced CPAs help business owners like you determine the best fit for their needs.

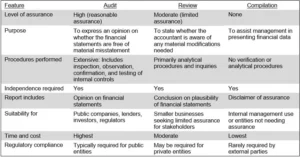

Here’s what you need to know about each option.